The traditional image of insurance – stacks of paperwork, long phone calls, and waiting for approvals – is quickly fading. Today’s tech-savvy insurance companies are embracing digital tools to streamline processes and empower policyholders as new trends are transforming the insurance industry. One key innovation is the insurance client portal, a secure online hub that puts you in control of your insurance experience.

What is an Insurance Client Portal?

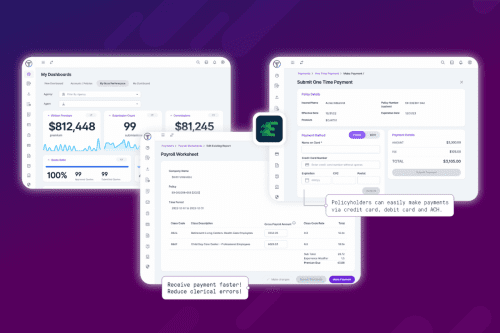

An insurance client portal is a web-based platform that allows agents and policyholders to access and manage their insurance information 24/7, from anywhere with an internet connection. Users are accustomed to regular updates with their social media and finance applications, so their insurance portal should offer that same modern feel. Modern client portals, like Trailblazer-Portal™, are designed specifically to enhance the client experience in the insurance industry while offering a modern, configurable interface that users have come to expect.

What to Expect from a Modern Insurance Client Portal

A well-designed insurance client portal can be a game-changer, streamlining the insurance experience for all users. Here are some of the key benefits to expect:

Streamlined Rating and Quotes

Remove the hassle and turnaround time associated with rating and quoting. Client and agent portals allow online submission, rating and quotes, often times in real time, eliminating excessive back and forth.

Effortless Policy Access

A client portal allows agents and policyholders to view all active policies in one convenient location. This includes essential details like the type of coverage, coverage limits, deductibles, and expiry dates. Having this information readily available empowers users to stay informed about your coverage.

Organized Document Storage

Say goodbye to lost paperwork! Clients can access and download policy documents, such as declarations pages and certificates of insurance, at any time. This eliminates the hassle of searching for physical copies and keeps everything organized.

Stress-Free Claims Management

Filing an insurance claim can be a hassle; however, a client portal simplifies the process by allowing agents and policyholders to initiate a new claim electronically. Upload necessary documents directly through the portal, eliminating the need to mail them in. Additionally, users can track the progress of claims and communicate directly with adjusters through secure messaging, keeping everyone in the loop, in real time.

Improved Agent Communication

Client portals foster better communication between insurers and their clients. This allows agents and policyholders to get the support needed on their own time, without the back-and-forth of phone calls.

Benefits of Using an Insurance Client Portal

Benefits of Using an Insurance Client Portal

Imagine managing policies with ease, ditching the phone calls and paperwork woes. That’s the power of an insurance client portal! Here’s a deeper dive into the numerous advantages a client portal offers:

Unmatched Convenience

Gone are the days of waiting on hold or digging through files. Client portals allow agents and policyholders to access and manage their insurance information 24/7, from anywhere with an internet connection. This flexibility empowers users to manage their insurance on their own schedule, freeing up valuable time for everyone involved.

Enhanced Transparency

Client portals bring clarity and understanding to coverages. Users can easily view your current policies, including coverage details like what’s insured, the extent of coverage, and deductibles. Expiry dates are readily available, so renewals are never missed. This transparency empowers users to make informed decisions about their insurance needs and avoid any coverage gaps.

Increased Efficiency

Eliminate the need for lengthy phone calls and mountains of paperwork. Additionally, many portals allow clients to make secure online payments, saving time and hassle. This efficiency translates to a smoother and less time-consuming insurance experience.

Improved Organization

Client portals function as a secure digital vault for all your crucial insurance documents. No more digging through countless stacks of paper. Policy documents, like declarations pages outlining your coverage details and certificates of insurance proving your coverage, are available for download at your fingertips, anytime you need them. This ensures everything stays organized in one central location, accessible at your convenience.

Empowerment and Control

Agents and policyholders are now in the driver’s seat. They can proactively manage coverage, understand policy details, and communicate directly with agents or brokers through secure messaging. This empowers them to make informed decisions, ask questions, and ensure their evolving insurance needs are being met.

Empowering Small Insurers and their clients

A modern client portal empowers both insurers and their clients with real-time access to coverages, claims, and communications. Agents and policyholders, especially those of small insurers, were with out-of-date technology solutions for far too long, but there are more options now than ever before bringing an affordable technology solutions to small insurers and their clients.

Trailblazer provides a comprehensive suite of insurance software solutions designed to revolutionize the client experience. Our solutions empower insurance companies to offer their agents and policyholders the benefits and convenience of a modern, user-friendly client portal while keeping costs low for small insurers.

Learn More About Streamlining Your Insurance Experience

Trailblazer is dedicated to helping insurance companies leverage technology to improve customer satisfaction and operational efficiency. Contact us today to learn more about how our solutions can transform your insurance business.

- Leveling Up: How Farm Mutuals Can Enhance Policyholder Experience with Insurtech - February 19, 2025

- 2025: The Year of Amazing Policyholder Experience - January 23, 2025

- 5 Trends Reshaping the P&C Insurance Landscape - January 7, 2025